The easiest way to afford travel is to have some kind of trust fund or rich parents… but what about us regular folks? Well, then it gets a little tougher. The key, unsurprisingly, is finding smart ways to budget your money and cut back on spending.

No duh, right? Luckily, most of the time the cutbacks are actually fairly common sense and painless but require self-restraint.

We’ve assembled some of our favorite money-saving strategies — some may work for you and some may not, but this list will help get you on the right path to affording that dream trip to Europe.

Step One: Research Your Spending Habits

The first step is knowing where you’re currently spending your money, so it’s time to take a hard look at your finances.

I like to use Mint to track and categorize my spending but do whatever is easiest for you (Excel spreadsheet, pen, and paper, etc.). If you’re serious about budgeting, you might want to check out You Need A Budget.

As you look through your expenses, mark down all the little extra things you spend your money on… you might be surprised how quickly it adds up. Then multiply that out by 12 months — it’s possible all those tiny purchases could add up to enough to spend a few weeks traveling around Europe.

Step Two: Start a Travel Fund

If you can afford it, set aside a little money from each paycheck and put it into a travel fund. If you put $20 aside each month, you’ll have saved over $1000 after a year — that’s about the cost of a roundtrip ticket to Europe. If you can save more, even better.

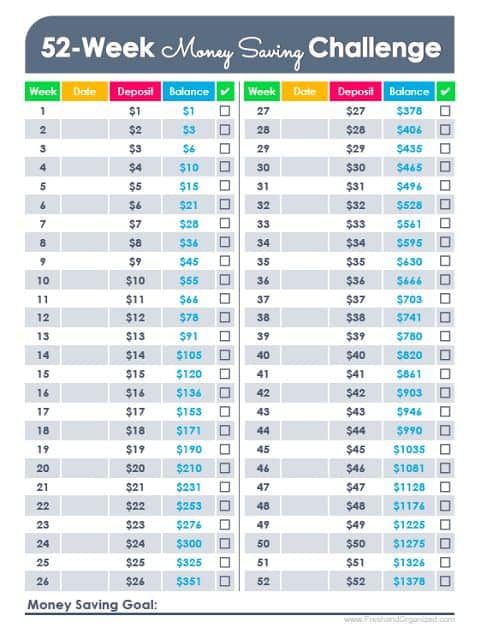

Another option is the 52-week money-saving challenge. Basically, you save $1 the first week, $2 the second week, $3 the third week, and so on. By the end of the year, you’ll have nearly $1400. This graph from Fresh and Organized illustrates this concept well.

Step Three: Get In the Travel-Saving Mindset

This step is all about getting yourself motivated and excited to travel — which makes saving easier.

Here is what I do: Before I make any purchase, I think about all the cool places I could go or see with that money. For example, is buying this Snickers bar now more important than buying an eclair in Paris?

I find one of the best ways to get motivated is through watching travel shows, watching foreign movies, and listening to international radio.

My Travel Inspiration

Anything Anthony Bourdain (RIP): Mr. Bourdain can do no wrong and just about everyone seems to love his shows. Many of his older episodes are available on Netflix.

I’ll Have What Phil’s Having: Phil Rosenthal is a comedian and writer (he wrote Everybody Loves Raymond), and he has a new travel show on PBS called I’ll Have What Phil’s Having — all the episodes are available to watch for free. Phil’s show revolves around his happy-go-lucky attitude about food and travel.

Rick Steves Europe: I love Rick and his shows are amazing. And even better, all his shows are available on his Youtube channel and on Hulu.

House Hunters International: This show is like crack for all of us who dream of moving overseas… I’m officially a junkie. There are a few episodes available on Netflix or Hulu (I can’t remember which), and there are a few full episodes available on the House Hunters International Website.

TuneIn Internet Radio: One of the best ways to get into the travel mood is to listen to European radio. TuneIn Internet Radio lets you listen to live radio for just about every radio station in the world.

Read Up: Author Bill Bryson is the most popular comedic travel writer, and he gives great insights into his travels. You can also read a few of the hundreds of travel guide books.

Step Four: Start Trimming the Expenses

Cutting back your expenses is the best way to beef up your travel savings. We’ve listed a few of the ways we’ve cut back on our spending, but not everything may apply to your situation.

Lower Your Housing Expenses

Housing is usually people’s highest expense, so if you want to save money, lowering your rent is the fastest way to free up a large chunk of change. Even lowering your rent by $100/month adds up quickly.

That means possibly finding roommates or moving to a smaller apartment or to a less-than-ideal location.

If you’re really committed to saving, you might consider moving back in with your parents (if you can stand it…). Six months of living rent-free will probably save you enough to travel for a few months.

Lower Your Food Expenses

Eating your meals out will absolutely kill your budget. I know from experience that living in a big city like NYC, SF, London, Paris, etc. can easily cost you $10+ for every lunch out. That’s an extra $200/month just for lunch. Bringing your own lunch will cost a small fraction of that.

The same goes for ordering dinner or going out to restaurants. I know the dangers of eating out all too well — we can easily spend $400+/month without realizing it.

If you’re lazy like I am, consider cooking in bulk and freezing the food so you just have to heat it up later. My brother-in-law spends a few hours every Sunday making meals for the entire week and it saves him a fortune.

Another option is to cut back on the meat as that is usually the most expensive part of the meal.

LifeHacker always has articles about saving money on food.

Get Sober

We try to limit how often we go out for drinks because it’s another budget killer — of course, this is easier said than done if your friends are always wanting to go out. Remember, happy hour is your friend!

Cut the Coffee/Energy Drinks, Etc.

Luckily I don’t drink coffee, but I know people that spend $5 each day to get their caffeine fix. However, I’m not completely off the hook because I like to buy other caffeinated drinks (about $2-$3 each). If you absolutely need a caffeine boost, you should check out caffeine pills or strong tea, or you can simply brew your own coffee.

Rent Your Place on Airbnb

I know plenty of people that make a nice chunk of change by renting their homes/apartments on Airbnb. I have a friend that rents her NYC apartment for one week a month (she stays with her boyfriend for that week), and the cash she makes from Airbnb is about equal to 3/4 of a month’s rent. I have other friends who rent their NYC or SF apartments for a month while they travel, and they make enough to cover their rent + overseas rent and travel experiences.

Pay Off Credit Cards and Loans

Of course, this is easier said than done, but you should pay off any credit cards as quickly as possible. I have friends that are paying hundreds of dollars each month in interest on credit cards.

Student loans are another huge issue for many young travelers. Obviously, we can’t just snap our fingers to pay off the loans, but you should do your best to pay them down.

Use Airline Points/Frequent Flyer Miles

Personally, I don’t know much about using credit cards to rack up frequent flier miles, but I know many people go crazy about it. So if you know how to get points this could be a great way to save $1000+.

Ditch the Car

For most people, a car is a necessity, but if you could do without one, you can save on gas, insurance, and general maintenance.

Cut Subscription Services

Spotify, Netflix, Hulu Plus, Tidal (lol, jk), all those monthly box services, etc. … they all add up.

Cut Cable

We ended our cable service years ago and we don’t miss anything… okay, there is some trashy TV we probably miss a little, but we’re still surviving. We find that Netflix and Amazon Prime streaming fulfill our television watching needs.

Electronics and Expensive Gadgets

Do you need the newest electronics and other gadgets as soon as they come out? I feel ya, but all that gear is pricy. I’m getting by just fine with my last generation iPhone and 5-year-old digital camera.

No New Clothes

If I need new clothes, I try to only buy them when they’re on sale. Stores like Gap seem to have 40% off sales all the time. Sometimes you can score some good items at thrift stores, secondhand stores, or even on eBay.

Buy It For Life

We live in a world where many of the things we buy are cheap, but they’re also more or less disposable or have a fairly limited lifespan. There is a concept called “buy it for life” where people say to spend extra money on products that last much longer. The classic example is boots — you can buy a nice pair of Red Wing boots that cost $300 but will easily last for 15-20 years, while a pair of $120 boots may only last a few seasons.

Side Gigs/Freelance

Are you a good writer? Can you do graphic design? How about coding? There are now tons of ways to do freelance work via the Internet, and you can make good money if your skill is in demand. The problem is that it often takes a few months to build up a client list, but there are lot of people making a good living this way.

Clip Coupons and Seek Out Deals

I’ve never gotten into coupon clipping, but some people out there are true masters that can get a whole shopping cart full of stuff for only a few dollars.

Buy Used/Refurbished/Last Season

For my first trip abroad, I bought my backpack off eBay for 1/2 the price of a new one. My Macbook Air is a refurb (it has the same warranty as a new computer). My Panasonic Lumix camera was a previous generation but still takes amazing photos.

Sell Old Stuff

We’ve all got old junk that we don’t use anymore, so why not try selling it? Who knows, you could have hundreds of dollars worth of junk hiding away.

High-Interest Online Savings Account

Most normal savings accounts offer virtually no interest on your savings, but a handful of banks offer a 1% return. Okay, so 1% isn’t much, but it’s better than nothing.

Quit Smoking

If you smoke, then you know how expensive a habit it is — and it gets a lot more expensive in Europe, so quit now.

Slash Movies/Entertainment

Being a hermit is no fun, but consider cutting back on expensive entertainment. We’re content with our Netflix and Amazon Prime Streaming for most of our entertainment needs.

Drop the Gym

Physical fitness is super important, so you may not want to cancel your gym membership if you actually go… however, cancel that bad boy if you don’t use it. Or consider getting into free activities like running, etc.

Don’t Shop Because of Sales

I get emails all the time from retailers announcing sales. This is great if I’m actually in need of something, but it’s not so great if I end up buying something I don’t need simply because it’s on sale.

Ask for Money

Birthdays, Christmas, weddings, and graduations are great occasions to score a little extra cash for your trip. People are usually more than happy to contribute to your travel funds if you ask.

Make a Fortune With a Travel Blog

I still haven’t figured this one out… so please let me know if you have the secret! 🙂

Actually, here is a guide to creating your own travel blog (but I can’t guarantee you’ll make any money).

Step Five: Learn How to Travel Cheaper

Ok, so you’ve found ways to save money so you can travel… now it’s time to find ways to get the most travel out of your money.

We’ve listed a few of our favorite money-saving travel articles (but nearly every article on our site revolves around traveling on a budget).

- European City Cost Guides

- Best Travel Backpack For Backpacking Europe

- Best Travel Shoes — Fashionable and Comfortable Shoes for Traveling

- Eurail Pass Review — Are Rail Passes Worth the Money?

- Complete Guide To Train Travel In Europe

- Tips for Finding Cheap Flights to Europe

- How to Find Cheap Flights within Europe

- Guide To Hostels in Europe: Bunk Beds, Beer, and Breakfast

- How To Couchsurf in Europe

- How to Eat and Drink on a Budget While Traveling in Europe

- How to Avoid Pickpockets and Outsmart Thieves in Europe

Do you have other money-saving tips? Share them in the comments!

No Funny Business

The Savvy Backpacker is reader-supported. That means when you buy products/services through links on the site, I may earn an affiliate commission—it doesn’t cost you anything extra and it helps support the site.

Thanks For Reading! — James

Questions? Learn more about our Strict Advertising Policy and How To Support Us.