Let’s talk about travel insurance. We receive a lot of questions from our readers asking us about the best travel insurance or if they even need it, so we wanted to give you the lowdown on this important, yet often confusing, subject.

Quick Guide To Travel Insurance

We’ve looked at all the most popular travel insurance companies and we like World Nomads — especially if you’re on a budget. Click here to learn more about World Nomads.

The Importance Of Travel Insurance

Do you absolutely need travel insurance? Probably not. But should you have travel insurance? We’d say yes.

Travel insurance is one of those things that most people think they don’t need or assume they’re already covered… but that’s not usually the case. For example, a lot of people assume their credit card or normal health insurance provides sufficient coverage — but that’s actually very rare.

Just think about it… travel is expensive. You’ve bought plane tickets, train tickets, accommodation, tours, travel gear, electronics, smartphones, laptops, and a bunch more. Travel insurance will help cover all those non-refundable things (plane tickets, train tickets, rental cars, tours, hotels, etc.). Insurance will offer compensation if your bags get lost or stolen. It can help if someone steals your expensive electronics. It will help if your flights get canceled or you can’t go on your trip for some reason.

And what if you have a medical emergency? Even something as simple as a visit to the hospital for dehydration can hundreds of dollars. But things like broken bones, ambulance rides, hospital stays, or medical evacuations can easily cost tens or hundreds of thousands of dollars.

Luckily, travel insurance is usually reasonably priced and the piece of mind is worth the extra $100-$300 for travel insurance.

What Does Travel Insurance Cover?

Each travel insurance plan will be different but most cover a few common things — medical emergencies, emergency evacuation, trip cancellation/interruption, lost luggage, and property theft/damage. The amount of compensation for each area will differ so we suggest reading the fine details.

Medical Emergencies

Your normal health insurance probably won’t cover you if you’re overseas — and if it does, it is still going to cost you a fortune if you get injured because you’ll be out of network. Travel insurance helps fill in this “emergency” gap in coverage.

You never know what could happen when you’re abroad. In South Africa I saw a car run a red light and hit an American girl who was crossing the crosswalk — the driver sped away but luckily she was relatively uninjured. I saw someone break their leg after a scooter hit them in Rome. I’ve seen people need to get treated at a hospital for dehydration because of food poisoning.

Emergency Evacuation

Sometimes you get injured far away from a hospital or you need to be moved to a different hospital for specialized treatment.

Other times your condition might require that you be flown back to your home country for treatment via a medical jet (which can cost over $50,000!). Emergency evacuation will cover those expensive costs.

Trip Cancelation, Interruption, and Flight Delays

A lot of people don’t realize how much of their trip is non-refundable. Airline and train tickets are often non-refundable. Tours are sometimes non-refundable. Accommodation is often non-refundable. The list goes on… so what happens if you have to cancel your trip? That’s right, you’re stuck paying for a trip you can’t go on.

Travel insurance will often cover those non-refundable things if you get sick before you leave, have a death in the family, natural disaster, or terrorist attack interfere with your travels.

Trip interruption insurance is similar as it covers you if you need to end your trip early for many of the same reasons listed above. For example, if you get injured halfway through, the insurance will cover the rest of your trip, and pay for your last-minute plane ticket back home.

A lot of insurance plans will cover the cost of a missed flight if your previous flight was delayed. This is helpful because many budget airlines won’t compensate for this. However, many plans have a clause stating that the delay must be 3+ hours long (so it’s no good if your layover was originally under 3 hours).

Lost Luggage, Theft, and Property Damage

Airlines lose luggage. Pickpockets and thieves can sneak away with your valuables. You can accidentally drop and break your expensive electronics.

Most insurance will cover the cost of buying new clothes if the airline loses your baggage. They’ll even pay for stuff if your baggage gets delayed a certain amount of time.

Travel insurance will help cover these costs. You’ll want to check out the fine print of your plan because the coverage will vary. For example, a lot of plans will only reimburse up to $500 per item. If you’re traveling with a lot of expensive gear then you should look into a supplemental plan.

What To Consider When Buying Travel Insurance

Here are a few things you’ll want to think about before buying travel insurance:

Think About What Coverage Is Important For YOUR Trip

Travel insurance comes in all shapes and sizes — which is one reason why finding the right policy can be confusing.

If you’re doing a mega trip around Europe, then it makes the most sense to buy a plan that has strong trip cancellation/interruption coverage, lost luggage, and medical emergency coverage.

However, remember that trip cancellation/interruption coverage only covers things that have been prepaid. Therefore, if you’re “winging it” and buying everything as you go, it might not make sense to pay extra for a plan that has a lot of cancellation/interruption coverage.

On the other hand, if you’ve repurchased all your flights, train tickets, accommodation, etc. then trip cancellation/interruption is very important because many of these things are non-refundable.

Are you going to be doing dangerous things like extreme sports or skiing? Make sure your policy covers that (many basic plans don’t) — you can often buy extra coverage.

Do you plan on driving a car? Look for a policy that covers that. Some credit cards will cover your auto insurance but not always. Be sure to look into that as you don’t want a nasty surprise that you’re not covered.

Do you plan on traveling with a bunch of expensive electronics? You may need to buy an extra plan that will help cover those items as many plans only offer around $500 worth of coverage.

Know What Your Travel Insurance Doesn’t Cover

Knowing what your travel insurance doesn’t cover is just as important as knowing what it does cover.

Travel insurance shouldn’t be treated as standard medical insurance. It’s really only for emergencies so don’t expect it to cover pre-existing conditions, pregnancy-related issues, normal checkups, etc.

As mentioned before, travel insurance usually doesn’t normally cover “high-risk” activities like gator wrestling, skydiving, skiing, SCUBA, etc. However, you can usually buy supplemental coverage if you’d like. Note: World Nomads does cover a lot of these high-risk activities for all your thrillseekers.

Most travel insurance companies only cover electronics if they get stolen from your person (i.e. by a pickpocket or mugging) or if they’re stolen while locked up. If you just leave stuff unattended it won’t be covered.

Furthermore, your electronics won’t be covered if you break them — unless your coverage states differently.

Know How Much Coverage You’re Getting

Some cheaper plans don’t offer a lot of protection. We’ve seen some that only offer $10-$50K in medical coverage — something like a broken bone and an ambulance ride could easily cost more than that amount of coverage. Personally, I’d stick with $100,000+ worth of coverage but you can easily find plans that offer much more.

Don’t Wait Too Long To Buy Travel Insurance

Most insurance policies require you to purchase your insurance before or near the time you made your first payment toward your trip (which is usually your flight or tour payment). If you wait too long then the insurance company may not cover you (World Nomads lets you buy while on the road).

As a rule, we recommend buying as soon as you have your travel dates set.

Read The Fine Print

This is the most annoying part of buying travel insurance but it’s important to know what you’re buying and how you’re covered. Spend 15 minutes and read through all that annoying stuff.

Check Your Credit Cards

Some credit cards offer insurance benefits for rental cars, lost luggage, trip cancellation, etc. — assuming you made the purchases with your card. Sometimes this coverage can be spotty but it doesn’t hurt to look.

Age Limits

Some insurance companies have an age limit. Other policies charge a boatload for people over 65 so you might have to do a little more searching if you fall into that age group.

Tips For Making A Travel Insurance Claim

Every travel insurance company will require paperwork and proof so here are some tips for making everything go smoothly.

Document EVERYTHING

You can never have enough paperwork. Document everything you can as this will help you get reimbursed much easier.

Take Photos Of Your Stuff

Take photos of all your stuff — especially expensive things. Take photos of serial numbers, too. We keep everything on a Google doc so it’s ready to send off if needed.

Make Copies Of Everything

Paperwork gets lost so you want to have backup copies (physical and electronic). This is super important and it could save you thousands of dollars and a lot of headaches.

Send Paperwork via Certified Mail

You can probably file claims via email, but if you send things via normal mail it pays to send it via certified mail.

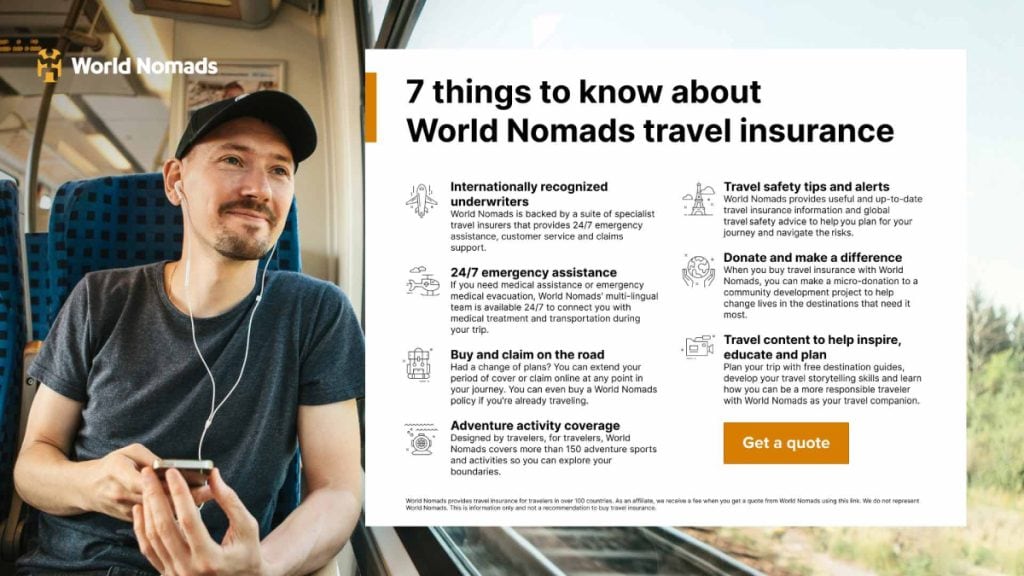

Popular Travel Insurance Pick For Budget Travel: World Nomads

We’ve compared multiple different insurance plans and we like World Nomads for a number of reasons:

Who are World Nomads?

Since 2002, World Nomads have been protecting, connecting, and inspiring independent travelers.

They offer simple and flexible travel insurance and safety advice to help you travel.

And they’ll help you plan your trip with free downloadable guides, travel tips, responsible travel insights, and recommendations from their global community.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

24/7 emergency assistance

If you need medical assistance or emergency medical evacuation, World Nomads‘ multi-lingual team is available 24/7 to connect you with medical treatment and transportation during your trip.

Buy and claim on the road

Had a change of plans? You can extend your period of coverage or claim online at any point in your journey. You can even buy a World Nomads policy if you’re already traveling.

Adventure activity coverage

Designed by travelers, for travelers, World Nomads covers over 150 adventure sports and activities so you can explore your boundaries.

Travel safety tips and alerts

World Nomads provides useful and up-to-date travel insurance information and global travel safety advice to help you plan for your journey and navigate the risks.

Travel content to help inspire, educate and plan

Plan your trip with free destination guides, develop your travel storytelling skills and learn how you can be a more responsible traveler with World Nomads as your travel companion.

Internationally recognized underwriters

World Nomads is backed by a suite of specialist travel insurers that provide 24/7 emergency assistance, customer service, and claims support.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Get A Travel Insurance Quote

We suggest visiting World Nomads to get a quote to learn more about their coverage options.

- Best Prepaid UK eSIM | Data Plan Buyer’s Guide - April 21, 2024

- How to Avoid Pickpockets in Europe — Tips for Outsmarting the Thieves - April 19, 2024

- Best Prepaid eSIM For Italy | Data Plan Buyer’s Guide - April 18, 2024

No Funny Business

The Savvy Backpacker is reader-supported. That means when you buy products/services through links on the site, I may earn an affiliate commission—it doesn’t cost you anything extra and it helps support the site.

Thanks For Reading! — James

Questions? Learn more about our Strict Advertising Policy and How To Support Us.